Is your business struggling with the challenges of manual identity proofing and verification for customer IDs during remote customer onboarding? The rise of digital transactions has created a pressing need for efficient and reliable identity verification solutions like DocuSign and AuthenticID. These solutions help streamline the client onboarding process and ensure scalability. Automated ID verification, also known as identity proofing, is revolutionizing the way businesses verify customer identities. With the integration of AuthenticID and DocuSign, the process becomes seamless, minimizing friction. Idenfy is another solution that enhances the efficiency of identity verification. With traditional methods prone to errors and time-consuming reviews, automated identity verification tools powered by AI, video, and document knowledge are reshaping the landscape of identity verification platforms. This game-changing scalability technology not only streamlines operations but also enhances security measures with its identity verification solution and software. Additionally, it prioritizes privacy. Join us as we delve into how automated ID verification with Docusign is shaping the future of identity authentication and privacy for signers in today’s fast-paced digital world.

The Essence of Automated ID Verification

Preventing Fraud

Automated ID verification is crucial for preventing fraud in industries like banking, insurance, and e-commerce. It helps to identify individuals accurately and protect their privacy. This process is especially important for customer support and platforms like DocuSign, where secure transactions are paramount. By swiftly authenticating customers’ identities using advanced technologies like artificial intelligence and machine learning algorithms, businesses can effectively ward off fraudulent activities. This can be achieved by implementing an identity verification solution or utilizing identity verification platforms and software, ensuring both security and privacy. For instance, a business like a bank, employing docusign integration with identity verification software, can instantly verify the authenticity of a customer’s identity documents when opening a new account. This helps to provide efficient and reliable support for the onboarding process.

Ensuring Compliance

The significance of automated ID verification also lies in its role in ensuring regulatory compliance for docusign software integration and customer support. Various business sectors are subject to stringent regulations mandating the use of robust identity verification software to prevent money laundering and other illicit activities. This software, such as Docusign, helps ensure secure and efficient verification processes for signers. Therefore, by integrating identity verification software into their business operations, companies can streamline compliance efforts while adhering to industry standards. This automated solution, such as DocuSign, can provide support for businesses in achieving efficient and secure document authentication.

Protecting Businesses and Customers

Moreover, automated ID verification plays a pivotal role in safeguarding both businesses and customers against potential risks associated with online transactions. With the support of Docusign software, signers can easily verify their identities, ensuring a secure and efficient process. This process reduces friction for users during onboarding procedures by implementing an identity verification solution, such as DocuSign, which is a reliable and efficient identity verification software. It not only improves the onboarding experience but also boosts conversion rates for businesses. Additionally, it offers comprehensive support to ensure a seamless process. By quickly validating customer identities through real-time verifications facilitated by docusign software, businesses can fortify their defenses against identity theft and fraudulent activities. This support from docusign is crucial for companies to safeguard their operations and protect their customers.

Faster Results

One of the primary benefits offered by docusign software is the rapidity at which it delivers accurate results compared to manual methods. This software provides support for automated ID verification, ensuring a quick and efficient process for signers. With the use of identity verification software, traditional methods often leading to delays due to manual processing requirements are replaced by automated solutions that cut down wait times significantly. This is especially beneficial when using platforms like Docusign, as signers can easily authenticate their identities and complete the process swiftly.

Resource Savings

Businesses can save significant time and resources by automating their identity verification process using docusign software. This frees up human capital from repetitive tasks that are prone to errors or inconsistencies. These saved resources could be redirected towards more value-adding endeavors within the organization, such as implementing docusign and identity verification software.

Enhanced Security Measures

Furthermore, implementing software for automated identity verification equips businesses with enhanced security measures designed specifically to protect against identity theft and fraudulent activities. The integration of identity verification software tools bolsters overall security postures across various touchpoints within an organization’s infrastructure.

Automated systems utilize advanced technologies such as artificial intelligence (AI) and machine learning (ML) algorithms for swift validation processes in identity verification software. Real-time verifications enable instant validation of customer identities without causing undue delays or disruptions. Seamless integration capabilities make it easy for organizations to implement automated identity verification software, thereby streamlining existing workflows effortlessly.

Understanding the Technology

How It Works

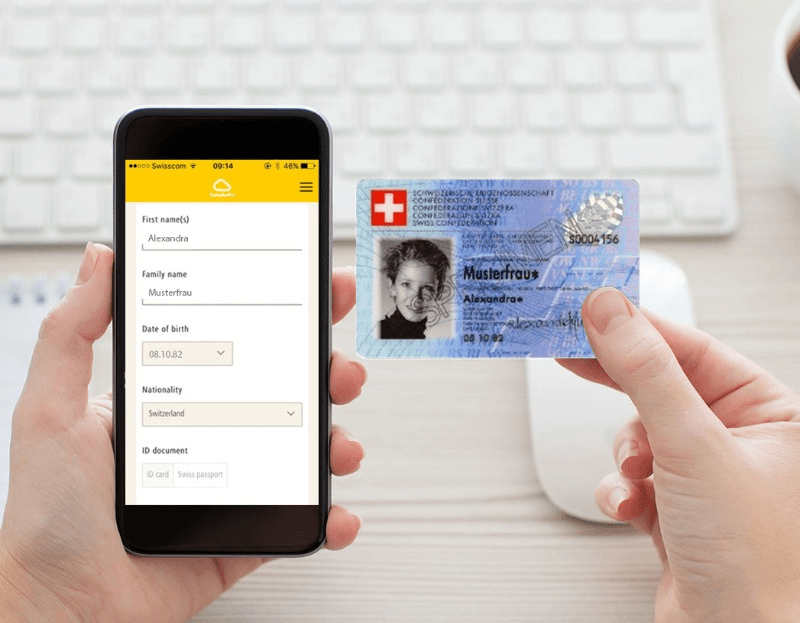

Automated ID verification utilizes document scanning, facial recognition, and data extraction techniques to verify a user’s identity. When a customer submits their identification document, such as a passport or driver’s license, the identity verification software extracts relevant information for analysis. This verification software ensures that the data is accurate and upholds security standards.

The process also involves comparing the user’s live image with the photo on their identification document using facial recognition technology. By doing so, it establishes whether there is a match between the two images, which is crucial in determining an individual’s true identity.

Data Extraction

Automated ID verification relies on advanced optical character recognition (OCR) technology to precisely extract essential customer data from various types of IDs. OCR plays a vital role in accurately capturing details from documents, ensuring that no critical information gets overlooked during the extraction process.

The extracted data serves as a foundation for further analysis and comparison during identity verification procedures. This enables organizations to cross-reference customer-provided information with official records to confirm its authenticity.

Similarity Checks

A pivotal aspect of automated ID verification is conducting thorough similarity checks between an individual’s live image and their photo on the identification document. Advanced algorithms meticulously analyze facial features to ensure high accuracy when determining matches between images.

These similarity checks are instrumental in detecting any fraudulent attempts involving stolen or fake identification documents. By scrutinizing facial characteristics closely, automated systems can effectively identify discrepancies that may indicate potential fraud.

Liveness Detection

Liveness detection stands as a critical component within automated ID verification processes since it confirms that individuals are physically present during identity validation. Techniques like eye movement tracking and monitoring facial gestures play key roles in verifying liveness.

Automated ID Verification in Various Industries

Fintech and Crypto

In the fintech and cryptocurrency industries, automated ID verification platforms play a crucial role in ensuring compliance with regulatory requirements such as Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. These automated solutions streamline the onboarding process for new customers, contributing to a positive user experience. For instance, when individuals open accounts on fintech apps or cryptocurrency exchanges, they are often required to undergo identity verification processes. Automated systems facilitate this by swiftly verifying users’ identities while adhering to strict regulatory standards.

Moreover, these platforms help financial institutions and crypto businesses prevent fraudulent activities by accurately identifying individuals engaging in transactions. By seamlessly integrating automated ID verification tools into their operations, companies can maintain high levels of security while efficiently processing large volumes of customer data.

E-Commerce

E-commerce businesses leverage identity verification platforms to safeguard against fraudulent transactions and protect their customers’ sensitive information. With the rise of online shopping, it has become increasingly important for e-commerce platforms to establish trust with their users. Automated ID verification not only enhances security but also contributes to reducing cart abandonment rates by streamlining the checkout process.

For example, when customers make purchases online or sign up for services on e-commerce websites, automated systems verify their identities using various methods such as document authentication or biometric recognition. This ensures that only legitimate users have access to the platform’s features and services.

Blockchain Integration

The integration of automated ID verification with blockchain technology offers enhanced security measures due to its immutable nature. By utilizing blockchain-based identity verification systems, organizations can significantly reduce the risk of data breaches since customer data is stored securely within decentralized networks.

Furthermore, these advanced systems provide users with greater control over their personal information compared to traditional centralized databases where third-party entities manage individuals’ data without direct consent or oversight from the users themselves.

The Mechanics of Automated ID Verification

User Onboarding

Automated ID verification streamlines the user onboarding process by eliminating the need for manual document submission and verification. This means that new users can sign up for services or open accounts without having to physically provide their documents, such as passports or driver’s licenses. As a result, the onboarding process becomes much faster, which not only enhances customer satisfaction but also reduces the likelihood of potential customers abandoning the registration process due to its lengthiness. Furthermore, automated ID verification allows businesses to verify customer identities remotely, enabling them to reach a global audience without compromising security.

For instance:

A fintech company can onboard new customers swiftly and securely by using automated ID verification during account creation.

An online marketplace can attract international sellers and buyers by offering a seamless registration process with remote identity verification.

Authentication Processes

Automated ID verification plays a crucial role in strengthening authentication processes by verifying multiple factors such as document authenticity and live facial recognition. By incorporating multi-factor authentication through automated ID verification, businesses add an extra layer of security against identity theft and fraudulent attempts to take over user accounts. Moreover, businesses have the flexibility to customize their authentication workflows based on their specific requirements.

For example:

A banking institution can enhance its security measures by implementing automated ID verification for both document validation and biometric authentication.

An e-commerce platform can offer secure transactions through multi-factor authentication powered by automated ID verification.

Compliance with KYC and AML

One of the key benefits of automated ID verification is ensuring compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. By leveraging this technology, businesses reduce the risk of facing penalties or reputational damage resulting from non-compliance with these regulations. It enables companies to conduct thorough due diligence on their customers, identifying potential risks associated with suspicious activities more effectively than traditional methods allow. Ongoing monitoring features further assist businesses in staying updated about changes in customer profiles that may indicate fraudulent behavior.

For instance:

A cryptocurrency exchange platform uses automated ID verification tools to comply with KYC/AML regulations while continuously monitoring customer profiles for any suspicious activities.

An insurance company employs advanced ID validation solutions for comprehensive customer due diligence as part of its regulatory compliance efforts.

Enhancing Security and User Experience

Fraud Prevention

Automated ID verification is essential in preventing fraud by detecting fake or stolen identification documents. Advanced algorithms analyze document security features to identify tampering attempts, ensuring the authenticity of submitted IDs. For example, if a customer tries to submit a photoshopped driver’s license as proof of identity, the automated system can quickly flag this as suspicious activity. Real-time verification allows businesses to flag such activities and take immediate action to prevent potential fraudulent transactions.

Moreover, real-time verification enables companies to monitor and track user behavior for any irregularities or suspicious patterns. This proactive approach helps in preventing fraudulent activities before they escalate into more significant issues for both businesses and customers.

Security Measures

The use of automated ID verification employs robust security measures that prioritize protecting sensitive customer data. Encryption techniques are used to ensure the secure transmission and storage of personal information during the verification process. These encryption methods safeguard customer data from unauthorized access or breaches while it is being transmitted over networks or stored within databases.

Furthermore, regular security audits and compliance checks maintain the integrity of the identity verification process. By consistently assessing its security protocols, organizations can stay ahead of potential vulnerabilities and adapt their systems according to evolving cybersecurity threats.

User Experience Improvements

Automated ID verification significantly enhances user experience by eliminating manual document submission processes often associated with traditional methods. Instead of having users physically present their IDs for inspection or submitting scanned copies via email, they can now simply upload images through an online platform for instant validation.

Seamless integration with existing platforms provides a frictionless onboarding experience for customers by allowing them to complete identity verifications without leaving the service interface they are already using.

User-friendly interfaces guide users through the entire verification process in a clear step-by-step manner that minimizes confusion and frustration commonly associated with cumbersome manual procedures.

The Role of Automation in Compliance and Fraud Deterrence

KYC and AML Automation

Automated ID verification plays a crucial role in automating Know Your Customer (KYC) and Anti-Money Laundering (AML) processes. By leveraging automated ID verification, businesses can significantly reduce the manual effort required for these compliance procedures. This not only saves time but also minimizes the possibility of human error, ensuring greater accuracy in customer screening. Moreover, automated ID verification allows companies to efficiently screen customers against global watchlists and databases. This means that they can swiftly identify any individuals or entities with suspicious backgrounds or affiliations, thereby enhancing security measures.

Continuous monitoring is another key benefit offered by automated ID verification systems. It enables businesses to stay on top of changing regulations by ensuring ongoing compliance with evolving legal requirements. With this capability, organizations can adapt swiftly to new regulatory standards without having to overhaul their entire compliance infrastructure each time a change occurs.

For instance:

An online financial services company utilizes an automated ID verification system to streamline its KYC processes. As a result, it experiences significant time savings while maintaining high levels of accuracy in customer screenings.

A retail bank employs continuous monitoring through automated ID verification to ensure that it remains compliant with shifting AML regulations, allowing it to promptly update its protocols when necessary.

Fraud Detection Features

In addition to simplifying compliance procedures, automated ID verification also incorporates robust fraud detection features that bolster a company’s defenses against illicit activities. These systems employ advanced technologies such as anomaly detection and pattern recognition powered by machine learning algorithms.

The utilization of machine learning algorithms is particularly impactful as they analyze data patterns within customer information submissions or transactional behaviors to pinpoint potentially fraudulent activities accurately.

Real-time alerts are another critical component of fraud detection features integrated into automated ID verification systems. Businesses receive immediate notifications about any suspicious behavior detected during the authentication process or subsequent interactions with customers. This empowers them to take swift action when potential threats arise, minimizing the impact of fraudulent incidents on their operations and safeguarding both their assets and clientele from harm.

For example:

An e-commerce platform leverages an automated ID verification solution equipped with machine learning-powered fraud detection capabilities which successfully identifies irregular purchasing patterns indicative of fraudulent transactions.

A digital payment provider benefits from real-time alerts within its automated ID verification system as it promptly flags unusual account access attempts for further investigation before unauthorized actions occur.

Cost Efficiency and Real-Time Processing

Cost Savings

Automated ID verification is a game-changer for businesses, as it slashes operational costs linked to manual identity verification processes. By automating repetitive tasks, companies can allocate resources more efficiently. This results in substantial cost savings through improved efficiency, reduced labor requirements, and minimized fraud losses.

For instance:

A financial institution implementing automated ID verification not only streamlines the onboarding process but also significantly reduces the need for manual labor. This leads to considerable cost savings while enhancing overall operational efficiency.

Moreover:

Businesses no longer have to allocate extensive human resources to manually verify customer identities. Instead, they can redirect these resources toward other critical areas of their operations.

Real-Time Verification

One of the most significant advantages of automated ID verification is its ability to provide real-time results. These instantaneous outcomes empower businesses to make prompt decisions without delays. Real-time verification is especially crucial for time-sensitive transactions and preventing bottlenecks in customer onboarding processes.

Consider this:

When a new customer applies for an account online, real-time ID verification allows the business to swiftly authenticate their identity without causing any unnecessary delays or inconvenience.

Furthermore:

With real-time results at their disposal, businesses can quickly identify potential risks and take appropriate actions without compromising efficiency or productivity.

Choosing the Right Automated IDV Solution

Screening Tools

Automated ID verification offers screening tools that help businesses verify customer identities against various databases. These tools are crucial for identifying individuals with a history of fraudulent activities or involvement in illegal practices. By using these screening tools, businesses can contribute to robust risk management strategies, ensuring a secure and trustworthy environment for their operations.

For example, financial institutions utilize automated IDV solutions to screen potential customers against sanction lists and watchlists. This process helps them identify individuals linked to money laundering or terrorist financing activities, thus preventing financial crimes.

Continuous monitoring is another essential feature of automated ID verification systems. With ongoing monitoring of customer profiles and activities, businesses can detect changes in customer behavior that may indicate fraudulent intent. This proactive approach enables companies to address suspicious activities promptly before they escalate into significant security breaches.

Monitoring Customers

The continuous monitoring capabilities integrated into automated ID verification systems play a pivotal role in maintaining a secure environment and preventing unauthorized access. By leveraging real-time alerts and notifications based on predefined criteria, businesses can take immediate action when unusual patterns or behaviors are detected within their customer base.

For instance, an e-commerce platform employing an automated IDV solution can monitor user activity such as login attempts from unfamiliar locations or sudden changes in purchasing behavior. Any deviations from normal patterns trigger alerts for further investigation by the business’s security team.

IDV Software Providers

Various IDV software providers offer tailored automated solutions designed to meet the specific needs of different industries and businesses. When selecting an automated ID verification solution, companies have the flexibility to choose from a range of providers based on factors such as pricing structures, available features, integration capabilities with existing systems, and scalability options.

Future Trends in Automated Identity Verification

Enhancements in Technology

Advancements in artificial intelligence and machine learning continuously enhance the accuracy and efficiency of automated ID verification. Ongoing research and development drive innovation, enabling businesses to leverage these technological enhancements to stay ahead of evolving fraud techniques. For example, advanced facial recognition technology now allows for more secure and reliable identity verification processes.

These technological advancements also contribute to the development of robust digital identity solutions that are increasingly difficult to compromise. By utilizing biometric data like fingerprints or iris scans, automated ID verification systems can provide a higher level of security while ensuring a seamless user experience. Businesses benefit from reduced fraud risk and improved customer trust when implementing these cutting-edge technologies.

Industry Adaptation

Various industries, including finance, healthcare, and travel, are rapidly adopting automated ID verification to strengthen their security measures while maintaining compliance with regulatory requirements. For instance, financial institutions are integrating automated ID verification into their onboarding processes to streamline customer due diligence procedures without compromising security standards.

Regulatory requirements play a significant role in driving the adoption of automated solutions across different sectors. As such, businesses must adapt by incorporating sophisticated identity verification tools that comply with industry-specific regulations. Customized identity verification workflows address industry-specific challenges effectively by tailoring the process according to unique sector demands.

Conclusion

So, there you have it – the ins and outs of automated ID verification. It’s more than just a fancy tech tool; it’s a game-changer in security, compliance, and user experience across various industries. As you’ve seen, this technology isn’t just about scanning IDs; it’s about revolutionizing how we establish trust and prevent fraud in our digital interactions.

Now that you’re in the know, it’s time to take action. Whether you’re in finance, healthcare, or any other sector, consider integrating automated ID verification into your processes. Stay ahead of the curve, boost security, and streamline your operations. The future is here, and it’s time to embrace the power of automated ID verification.

Frequently Asked Questions

What are the benefits of automated ID verification?

Automated ID verification offers enhanced security, improved user experience, cost efficiency, and real-time processing. It also plays a significant role in compliance and fraud deterrence while catering to various industries.

How does automated ID verification work?

Automated ID verification utilizes advanced technology to verify an individual’s identity by cross-referencing their provided information with authoritative sources such as government databases or credit bureaus.

What industries can benefit from automated ID verification?

Various industries such as finance, healthcare, e-commerce, and travel can benefit from automated ID verification to streamline customer onboarding processes and enhance security measures.

How does automation improve compliance and fraud deterrence?

Automation ensures that regulatory requirements are consistently met through standardized processes while effectively detecting fraudulent activities in real time.

What should businesses consider when choosing an automated digital identity verification (IDV) solution? Businesses need to carefully evaluate the features and benefits of different identity verification software and tools to ensure they select the most effective identity verification service for their needs.

Businesses should consider factors like accuracy, scalability, integration capabilities with existing systems, regulatory compliance adherence, and the ability to adapt to future industry trends.

Add a Comment