Bank customer onboarding has transformed as digital banking becomes the norm. Traditional onboarding methods that depend on branch visits, paper forms, and manual document checks no longer match how customers want to interact with banks. Today, users expect fast, secure, and fully online onboarding experiences.

At the same time, banks face rising identity fraud, stricter regulatory requirements, and increasing pressure to deliver seamless digital journeys. Manual verification struggles to balance speed, accuracy, and compliance, often resulting in delays and customer drop-off.

This is where IDVT plays a crucial role. Identity Document Validation Technology enables banks to validate identity documents digitally and confirm that a real person is present during onboarding.

In this blog, we explore what IDVT is, why banks need it, how it works in customer onboarding, and how document recognition and liveness technologies strengthen modern IDVT systems.

What Is IDVT in Banking

IDVT, or Identity Document Validation Technology, refers to the digital process banks use to validate identity documents and ensure they belong to the person submitting them.

IDVT supports both identity verification and document verification by analyzing documents such as passports, national IDs, and driver’s licenses. It checks document structure, security features, and data consistency to detect forged or altered documents.

Unlike manual document checks, IDVT systems rely on automation. This improves accuracy, reduces processing time, and ensures consistent verification decisions across all customer onboarding journeys.

Why Banks Need IDVT Today

The rapid growth of online and mobile banking means more customers onboard remotely, without face-to-face verification. This increases exposure to impersonation and document fraud.

Banks are also seeing a rise in fake and manipulated identity documents, often combined with stolen identities. Manual reviews are no longer reliable at scale.

Regulatory requirements such as KYC verification and eKYC verification demand accurate identity checks, repeatable processes, and clear audit trails.

Finally, customers expect fast onboarding. Lengthy verification steps lead to abandoned applications and lost revenue.

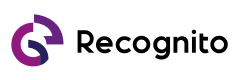

How IDVT Works in Bank Customer Onboarding

IDVT integrates directly into digital onboarding workflows to automate identity validation from start to finish.

Step 1: Document Capture and Validation

Customers upload or scan their identity document using a mobile device or web interface. IDVT systems perform identity document validation by analyzing document layout, security elements, and data integrity.

This document check helps detect forged, expired, or tampered documents early in the onboarding process. Banks evaluating real-world document validation workflows can explore practical examples through the ID document verification playground, which demonstrates how document recognition works in live onboarding scenarios.

Step 2: Identity Verification and Authentication

Once the document is validated, the system verifies that the applicant is the rightful owner. This step combines ID verification and ID authentication to reduce impersonation risk.

Biometric verification is commonly used at this stage. The accuracy of facial recognition technologies used in banking is independently evaluated through the NIST Face Recognition Vendor Test (FRVT), which provides transparent benchmarks for real-world biometric performance.

Step 3: Automated Decision Making

IDVT delivers real-time verification results, allowing banks to approve, reject, or flag applications instantly. Automation reduces manual review and significantly speeds up onboarding.

Detailed biometric performance benchmarks, including one-to-one identity matching accuracy, are published in the 1:1 verification results, helping banks objectively assess facial recognition reliability.

Key Benefits of IDVT for Banks

IDVT delivers value across security, compliance, and operations.

Faster Customer Onboarding

Automated identity checks reduce onboarding time from days to minutes, improving completion rates and customer satisfaction.

Stronger Fraud Prevention

Reliable identity verification prevents identity fraud and fake account creation by detecting document and identity mismatches early.

Improved Compliance

IDVT supports KYC and eKYC verification by applying consistent validation logic and generating audit-ready records.

Operational Efficiency

Automation lowers operational costs and enables scalable online verification as customer volumes grow.

IDVT vs Traditional Bank Onboarding Methods

Traditional onboarding relies heavily on manual reviews and physical branch visits. While familiar, these methods are slow and difficult to scale.

| Aspect | Traditional Process | IDVT-Based Onboarding |

| Speed | Slow and manual | Fast and automated |

| Accuracy | Human-dependent | Rule- and AI-driven |

| Fraud Detection | Limited | Advanced document verification |

| Scalability | Low | High |

| Customer Experience | Friction-heavy | Smooth and digital |

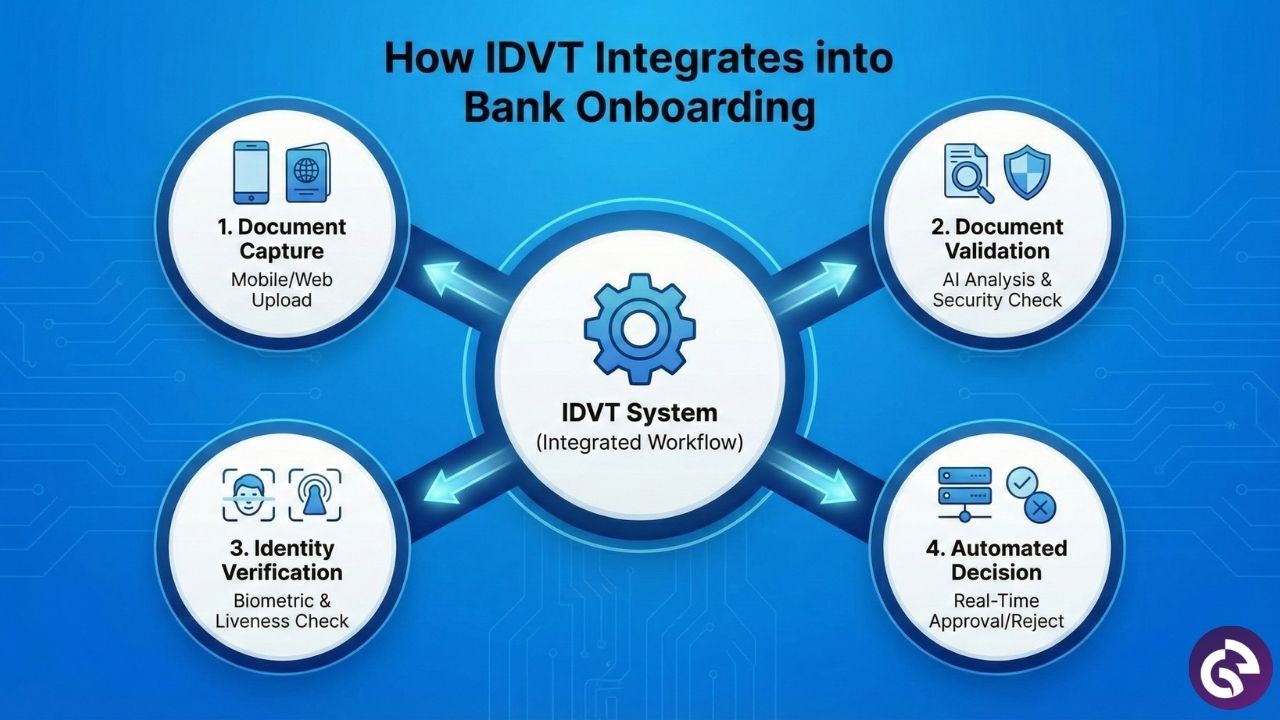

Key Features Every IDVT Solution Must Have

Accuracy and Coverage

An effective IDVT system must support a wide range of global identity documents and deliver reliable document verification.

Security and Compliance

Strong data protection and regulatory alignment are essential. Many institutions reference digital identity and security best practices published by EDUCAUSE when designing secure onboarding systems.

Integration and Scalability

IDVT solutions should integrate easily with existing onboarding platforms and scale efficiently as customer demand increases.

How Recognito Supports IDVT Systems

Recognito delivers core technologies that power IDVT systems, including:

- ID document recognition for accurate data extraction

- Document liveness detection to confirm real document presence

- Face liveness detection to ensure a real applicant is present

These components help banks and solution providers build secure and scalable IDVT workflows without relying on manual checks.

Technical teams can explore implementation resources and SDK examples through the Recognito GitHub repository.

Contact Recognito to learn how our document recognition and liveness technologies can strengthen your IDVT architecture.

Conclusion

IDVT has become a foundation of secure and scalable bank onboarding. As digital banking continues to grow, banks must move beyond manual processes that slow onboarding and increase fraud risk.

By implementing IDVT supported by document recognition and liveness technologies, banks can improve onboarding speed, strengthen compliance, and protect against identity fraud.

For banking decision-makers, IDVT is no longer optional. It is essential for delivering secure, customer-friendly digital banking experiences.

Frequently Asked Questions

What is IDVT in banking?

IDVT is Identity Document Validation Technology used to validate identity documents during digital onboarding.

How does IDVT support KYC verification?

It automates document checks and identity validation to ensure consistent and compliant KYC processes.

Is IDVT required for online banking onboarding?

While not always mandatory, IDVT is strongly recommended for secure and scalable onboarding.

How accurate is IDVT for document verification?

Accuracy depends on the quality of document recognition and biometric validation technologies used.

Can IDVT reduce onboarding fraud?

Yes, IDVT significantly reduces identity fraud by validating documents and confirming real user presence early.