You know that moment when a new app asks for your ID and selfie before letting you in? You sigh, snap the photo, and in seconds it says “You’re verified!” It feels simple, but behind that small step sits an advanced system called ID verification services that keeps businesses safe and fraudsters out.

In today’s digital world, identity verification isn’t a luxury. It’s a necessity. Without it, online platforms would be a playground for scammers. That’s why more companies are turning to digital ID verification to secure their platforms while keeping user experiences smooth and fast.

How ID Verification Evolved into a Digital Superpower

Not too long ago, verifying someone’s identity meant visiting a bank, filling out forms, and waiting days for approval. It was slow and painful. Today, online identity verification has turned that ordeal into a 10-second selfie check.

| Feature | Traditional ID Checks | Digital ID Verification |

| Time | Days or weeks | Seconds or minutes |

| Accuracy | Prone to human error | AI-powered precision |

| Accessibility | In-person only | Anywhere, anytime |

| Security | Paper-based | Encrypted and biometric |

According to a Juniper Research 2024 report, businesses using digital identity checks have reduced onboarding times by 55% and cut fraud by nearly 40%. That’s not an upgrade, that’s a revolution.

How ID Verification Services Actually Work

It looks easy on your screen, but behind the scenes, it’s like a full orchestra performing perfectly in sync. When you upload your ID, OCR technology instantly extracts your details. Then, facial recognition compares your selfie to the photo on your document, while an ID verification check cross-references the data with secure global databases.

All this happens faster than your coffee order at Starbucks. And yes, it’s fully encrypted from start to finish.

If you want to see how global accuracy standards are tested, visit the NIST Face Recognition Vendor Test (FRVT). This benchmark helps developers measure the precision of their facial recognition algorithms.

Why Businesses Are Making the Shift

Let’s be honest, no one likes waiting days to get verified. Businesses know that, and users expect speed. So, they’re shifting from manual checks to identity verification solutions that deliver results in real time.

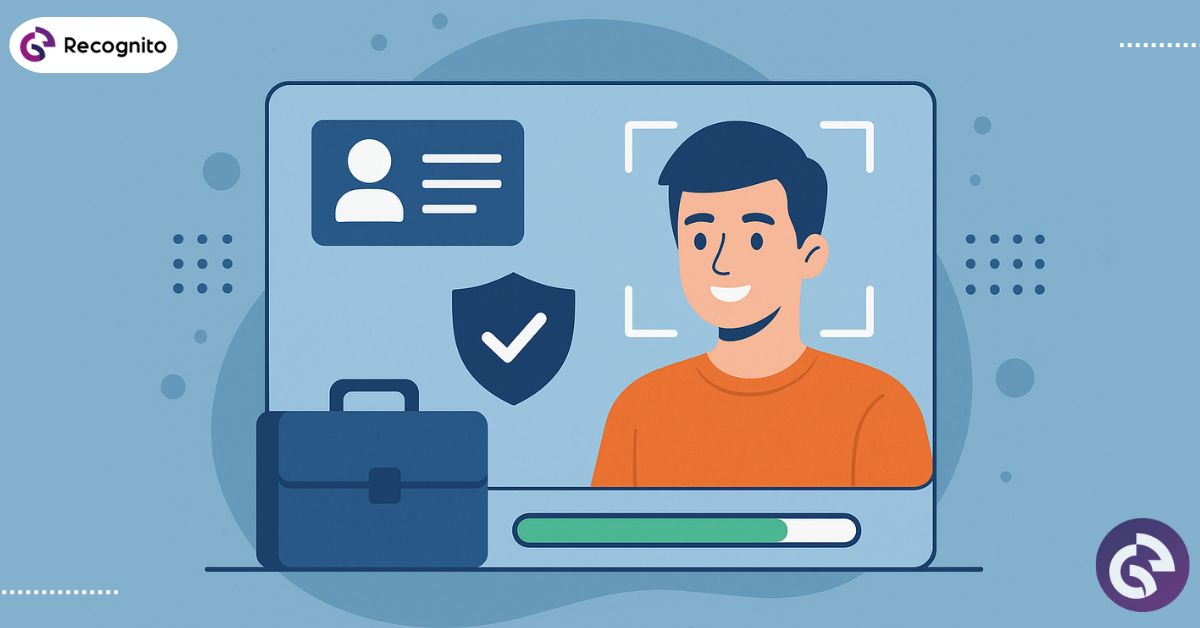

ID verification software gives businesses an edge by:

- Cutting down on manual reviews

- Reducing fraud risks through AI analysis

- Staying compliant with rules like GDPR

- Enhancing global accessibility

A McKinsey & Company study found that businesses using automated ID verification checks experienced up to 70% fewer fraudulent sign-ups. Another Gartner analysis (2023) reported that automation in verification reduces onboarding costs by over 50%.

So, businesses aren’t just going digital for fun; they’re doing it to stay alive in a market where users expect instant trust.

The Technology Making It All Possible

Every smooth verification hides some serious tech genius. Artificial intelligence detects tampered IDs or fake lighting, while machine learning improves detection accuracy over time. Facial recognition compares live selfies to document photos, even if your hair color or background lighting changes.

The FRVT 1:1 results show that today’s best facial recognition models are over 20 times more accurate than they were a decade ago, according to NIST.

Optical Character Recognition (OCR) handles the text on IDs, and encryption ensures data privacy. It’s these small but powerful innovations that make modern ID document verification fast, secure, and scalable.

Want to explore real-world tech examples? Visit the Recognito Vision GitHub, where you can see how advanced verification systems are built from the ground up.

Why It’s a Smart Investment

Investing in reliable ID verification solutions isn’t just about compliance, it’s about building customer trust. When users feel safe, they’re more likely to finish sign-ups and come back.

According to Statista’s 2024 Digital Trust Report, companies using digital identity verification saw conversion rates increase by 30–35%. That’s because users today value both speed and security.

So, when you invest in this technology, you’re not just protecting your business. You’re giving users the confidence to engage without hesitation.

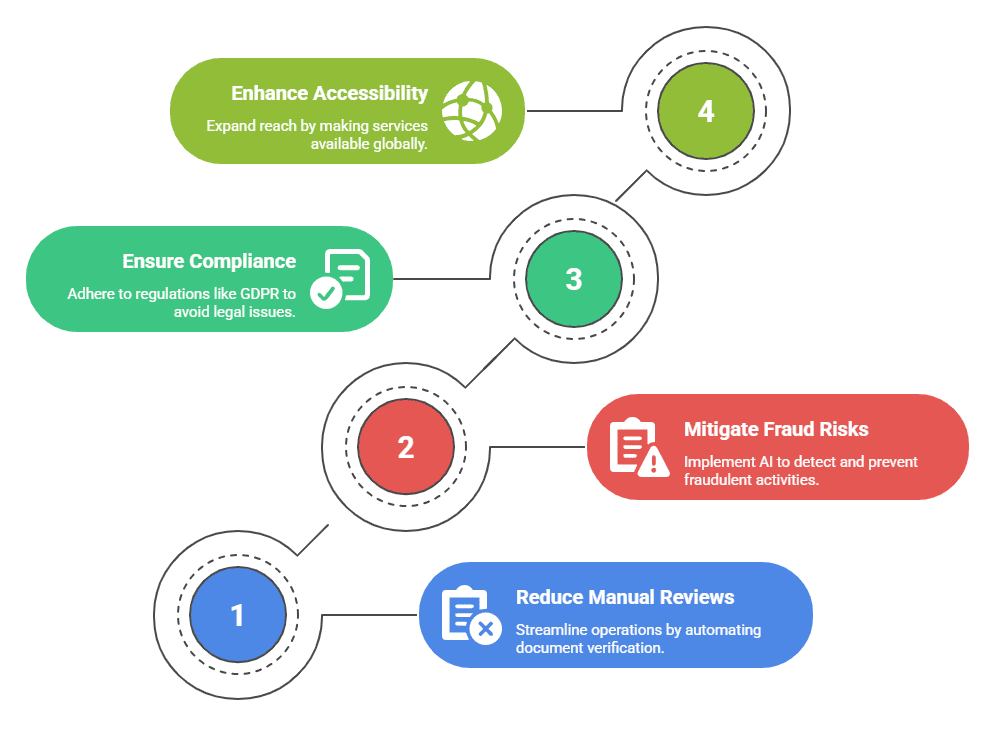

Where ID Verification Shines

The beauty of user ID verification is that it works across every industry. It’s not just for banks or fintech startups.

- In finance, it prevents money laundering and fraud.

- In healthcare, it confirms patient identities for telemedicine.

- In eCommerce, it helps fight fake orders and stolen cards.

- In gaming, it enforces age restrictions.

- In ridesharing and rentals, it keeps both parties safe.

According to a 2022 IBM Security Study, 82% of users say they trust companies more when those companies use digital identity checks. That’s how powerful this technology is; it builds credibility while keeping everyone safe.

Recognito Vision’s Role in Modern Verification

For businesses ready to step into the future, Recognito Vision makes it simple. Their ID document recognition SDK helps developers integrate verification directly into apps, while the ID document verification playground lets anyone test the process firsthand.

Recognito’s platform blends AI accuracy, fast processing, and user-friendly design. The result? Businesses verify customers securely while users hardly notice it’s happening. That’s efficiency at its best.

Challenges to Consider

Of course, nothing’s perfect. Some users hesitate to share IDs online, and global documents come in thousands of formats. Integrating verification tools into older systems can also feel tricky.

However, choosing a trustworthy ID verification provider can solve most of these issues. As Gartner’s 2024 Cybersecurity Trends Report points out, companies that adopt verified digital identity frameworks see significantly fewer data breaches than those using manual checks.

So while there are challenges, the benefits easily outweigh them.

The Road Ahead

The next phase of digital identity verification is all about control and privacy. Imagine verifying yourself without even sharing your ID. That’s what decentralized identity systems and zero-knowledge proofs are bringing to life.

According to the PwC Global Economic Crime Report 2024, widespread digital ID verification could save over $1 trillion in fraud losses by 2030. That’s not science fiction, it’s happening right now.

The world is heading toward frictionless, instant trust. And businesses that adopt early will lead the pack.

Final Thoughts

At its core, ID verification services aren’t just about checking who someone is. They’re about creating confidence for users, for businesses, and for the digital world as a whole.

If you’re a company ready to modernize and protect your platform, explore Recognito Vision’s identity verification solutions. Because in an era of deepfakes, scams, and cyber tricks, the smartest move is simply knowing who you’re dealing with safely, quickly, and confidently.

Frequently Asked Questions

1. What are ID verification services and how do they work?

ID verification services confirm a person’s identity by analyzing official ID documents and matching them with facial or biometric data using AI technology.

2. Why are ID verification services important for businesses?

They help businesses prevent fraud, comply with KYC regulations, and build customer trust through secure and fast verification processes.

3. Is digital ID verification secure for users?

Yes, digital ID verification is highly secure because it uses encryption, biometric checks, and data protection standards to keep user information safe.

4. How do ID verification services help reduce fraud?

They detect fake or stolen IDs, verify real users instantly, and prevent unauthorized access, reducing fraud risk significantly.

5. What should businesses look for in an ID verification provider?

Businesses should look for providers that offer fast results, global document support, strong data security, and full regulatory compliance.