You’ve probably seen that pop-up asking you to verify your identity when signing up for a new banking app or wallet. That’s KYC, short for Know Your Customer. It helps businesses confirm that users are real, not digital impostors trying to pull a fast one.

In the old days, this meant long queues, forms, and signatures. Today, KYC verification online makes that process digital, instant, and painless.

Here’s how the two compare.

| Feature | Traditional KYC | Online KYC Verification |

| Time Taken | Days or weeks | A few minutes |

| Method | Manual paperwork | Automated verification |

| Accuracy | Prone to error | AI-based precision |

| Accessibility | Branch visits required | Anywhere, anytime |

| Security | Paper-based | Encrypted and biometric |

According to Deloitte’s “Revolutionising Due Diligence for the Digital Age”, digital verification and automation can drastically improve compliance efficiency and customer experience, both of which are central to modern financial services.

That’s why KYC verification online has become the backbone of secure onboarding for fintechs, banks, and even government platforms.

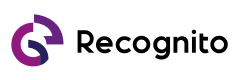

How KYC Verification Online Actually Works

When you perform a KYC check online, it feels quick and effortless, but behind that simple process, powerful AI is doing the hard work. It matches your selfie with your ID, reads your details using OCR, and cross-checks everything with trusted databases, all in seconds.

Here’s what’s really happening:

- You upload your ID (passport, driver’s license, or national ID).

- You take a quick selfie using your phone camera.

- The system compares your selfie to the photo on your ID using advanced facial recognition.

- OCR (Optical Character Recognition) extracts the text from your ID to verify your name, address, and date of birth.

- Data is validated against government or regulatory databases.

- You get approved often in under two minutes.

That’s KYC authentication in action: fast, secure, and contact-free.

According to the NIST Face Recognition Vendor Test (FRVT), today’s leading algorithms are over 20 times more accurate than those used just a decade ago. That leap in precision is one reason why eKYC verification is now trusted by global banks and fintech companies.

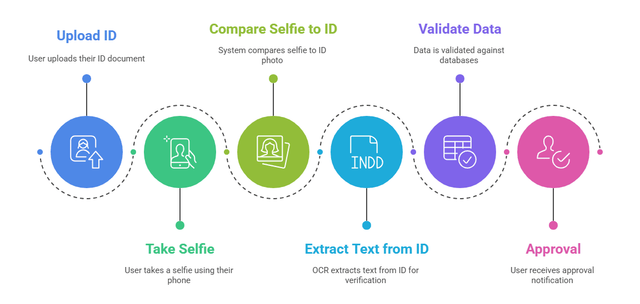

Why Businesses Are Switching to KYC Verification Online

No one enjoys filling out endless forms or waiting days for approvals. That’s why businesses everywhere are turning to KYC verify online systems; they make onboarding smoother for customers while cutting costs for organizations.

Some of the biggest reasons behind this shift include:

- Faster onboarding times that enhance customer experience.

- Greater accuracy from AI-powered checks.

- Enhanced fraud detection through biometric validation.

- Regulatory compliance with frameworks like GDPR.

- Global accessibility for users to verify KYC online anytime, anywhere.

Research by Deloitte Insights notes that organizations automating due diligence and verification processes reduce manual costs while increasing compliance accuracy, a huge win for financial institutions managing high user volumes.

Simply put, online KYC check systems help companies onboard customers faster while minimizing human error and fraud.

Technology Behind Modern KYC Verification Solutions

Every smooth verification process is powered by some serious tech muscle.

Artificial Intelligence (AI) helps detect fraudulent IDs and spot manipulation patterns in photos. Machine learning continuously improves accuracy by learning from new data. Facial recognition verifies your selfie against your ID photo with pinpoint precision, tested under the NIST FRVT benchmark.

Meanwhile, Optical Character Recognition (OCR) pulls data from your documents instantly, and encryption technologies protect that data as it moves across systems.

For developers and organizations wanting to implement their own KYC verification solutions, Recognito’s face recognition SDK and ID document recognition SDK are reliable tools that simplify integration.

You can also explore Recognito’s GitHub repository to see how real-time AI verification systems evolve in practice.

How to Verify Your KYC Online Without the Hassle

If you haven’t tried KYC verification online yet, it’s simpler than you think. Just open the app, upload your ID, take a selfie, and let the system handle the rest.

Most platforms now allow you to check online KYC status in real time. You’ll see exactly when your verification moves from “in review” to “approved.”

Curious about how it all works behind the scenes? Try the ID Document Verification Playground. It’s an interactive way to see how modern KYC systems scan, process, and authenticate IDs no real data required.

According to Allied Market Research, the global eKYC verification market is expected to reach nearly $2.4 billion by 2030, growing at over 22% CAGR. That surge shows just how essential digital KYC has become to the future of online services.

The Future of KYC Authentication

The next generation of KYC authentication is going to feel almost invisible. Biometric technology and AI are merging to make verification instant; imagine unlocking your account just by looking at your camera.

In India, systems like UIDAI’s Aadhaar e-KYC have already transformed how millions of users open bank accounts and access government services. It’s fast, paperless, and secure.

Global research by PwC on Digital Identity predicts that the world is moving toward a unified digital identity model, one verified profile for all services, from banking to healthcare.

This is the future of KYC identity verification: a seamless, secure, and user-friendly process that builds trust without slowing you down.

Final Thoughts

In the end, KYC verification online is about more than compliance; it’s about confidence. It ensures that businesses and customers can interact safely in an increasingly digital world.

It eliminates paperwork, reduces fraud, and makes onboarding faster and smarter. That’s progress everyone can appreciate.

If you’re a business exploring modern KYC verification solutions, check out Recognito. Their AI-powered technology helps companies verify identities accurately, comply with regulations, and create frictionless user experiences.

Frequently Asked Questions

1. How does KYC verification online work?

You upload your ID, take a selfie, and the system checks both using AI. KYC verification online confirms your identity in just a few minutes.

2. Is eKYC verification safe to use?

Yes, eKYC verification is secure since it uses encryption and biometric checks. Your personal data stays protected throughout the process.

3. What do I need to verify my KYC online?

To verify KYC online, you only need a valid government ID and a selfie. The rest is handled automatically by the system.

4. Why are companies using online KYC checks now?

Businesses use online KYC check systems because they’re faster and help prevent fraud. It also makes onboarding easier for users.

5. What makes a good KYC verification solution?

A great KYC verification solution should be fast, accurate, and compliant with privacy laws. It should make KYC identity verification simple for both users and companies.