Digital onboarding has made it easier than ever for businesses to reach customers worldwide. At the same time, it has also opened the door to new forms of document fraud and identity misuse. Fraudsters now exploit screenshots, stolen ID images, and manipulated files to bypass traditional checks that were never designed for remote verification.

This is why KYC verification has become a cornerstone of trust in modern digital services. Regulators expect businesses to verify customers accurately, prevent fraud, and protect financial systems. As onboarding moves online, simply collecting an ID document is no longer enough. Businesses must ensure that the document is real, live, and presented by a genuine user.

In this article, you will learn what ID document liveness detection is, why it has become essential for KYC verification, how it strengthens identity verification, and how businesses can use it to improve fraud prevention, compliance, and customer trust.

Understanding KYC Verification in the Digital Era

KYC verification refers to the process of confirming a customer’s identity before granting access to services. It is a regulatory requirement for many industries, particularly financial services, fintech, and digital platforms that handle sensitive data or transactions.

Customer verification has increasingly shifted toward online and remote channels. Users now expect to open accounts and verify identities instantly, without visiting physical locations. While this improves convenience, it also increases the risk of identity misuse if verification controls are weak.

At the center of KYC compliance are ID verification and identity verification, which ensure that both the document and the individual behind it are legitimate. Regulatory bodies such as the Financial Action Task Force emphasize strong identity controls as a fundamental requirement for digital KYC programs.

The Hidden Dangers Behind Digital Document Fraud

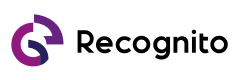

Fraudsters deliberately target digital onboarding systems because uploaded documents are easier to manipulate than in-person checks. Many platforms still rely on static image uploads, which creates blind spots that attackers actively exploit.

Common risks businesses face without proper document liveness detection include:

- Increased exposure to document fraud and impersonation

- Higher chances of failed compliance audits

- Financial losses from fraudulent accounts

- Long-term reputational damage

As onboarding volumes grow, even a small percentage of fraudulent verifications can have a significant impact on business operations and regulatory standing.

Fake and Altered Identity Documents

Fraudsters frequently modify identity documents by changing names, photos, or dates. These altered files often pass basic OCR and visual checks because they appear authentic at first glance. Without real-time validation, detecting such fraud becomes extremely difficult.

Reused and Stolen Document Images

Another growing threat involves reused document images. Screenshots, printed IDs, and previously captured photos are submitted repeatedly across platforms. Static verification systems cannot tell whether the document is being physically presented or simply replayed.

What Is ID Document Liveness Detection

ID document liveness detection verifies that an identity document is physically present during the verification process. Instead of analyzing a static image alone, it checks for movement, reflections, and interaction patterns that confirm real-world presence.

Unlike basic document checks, document liveness prevents attackers from using screenshots or injected images. As part of AI verification, it acts as a critical layer that strengthens KYC verification by validating authenticity in real time.

How Liveness Detection Strengthens KYC Verification

Modern KYC systems rely on multiple verification signals working together. Document liveness detection plays a vital role in closing gaps left by traditional methods.

It strengthens KYC verification by:

- Confirming that a document is real and physically present

- Blocking replay attacks using screenshots or recorded videos

- Supporting secure identity verification when combined with biometric checks

This layered approach significantly improves fraud prevention without adding unnecessary friction for genuine users.

Detecting Real vs Fake Documents

Liveness detection analyzes motion, light behavior, and document handling patterns to distinguish genuine documents from fakes or digital copies.

Preventing Replay and Injection Attacks

By requiring real-time interaction, document liveness blocks static images and injected feeds that would otherwise bypass upload-based systems.

Supporting Secure Identity Verification

When combined with facial liveness, document liveness ensures that the document belongs to a real, live user, reducing impersonation risks.

ID Document Liveness vs Traditional Document Verification

Traditional document verification relies on manual review or OCR-based analysis. While these methods can extract text, they cannot verify whether a document is live or authentic.

Manual checks are slow and inconsistent, while OCR lacks physical validation. Document liveness detection fills this gap by adding real-time verification, making modern KYC workflows significantly more resilient to fraud.

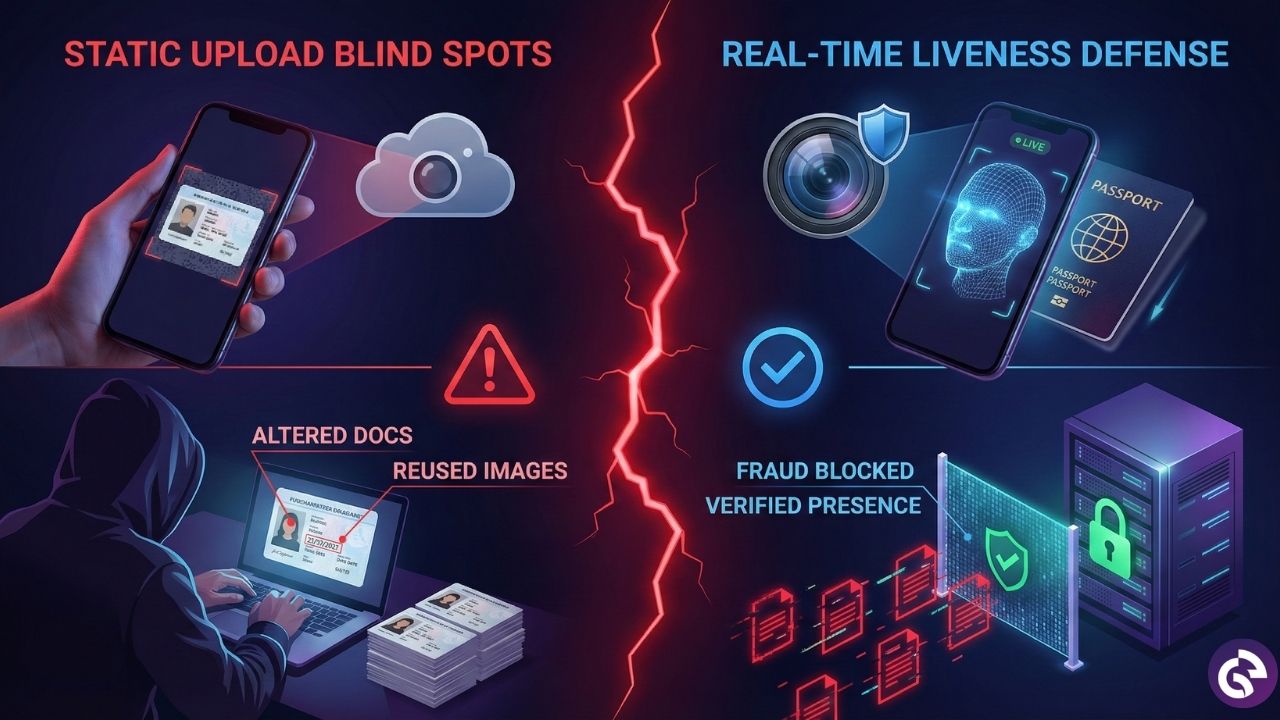

Key Benefits of ID Document Liveness Detection

ID document liveness delivers meaningful advantages across security, compliance, and scalability.

Stronger Fraud Prevention

By blocking altered, reused, and injected documents, liveness detection reduces document fraud and identity misuse.

Faster and Safer Customer Verification

Automated verification speeds up onboarding while maintaining strong security standards.

Improved KYC Compliance

Document liveness supports regulatory expectations by demonstrating robust identity verification controls.

Scalable AI Verification

AI-driven liveness detection scales easily as onboarding volumes grow, without increasing operational risk or cost.

Industries That Benefit Most From Document Liveness

Document liveness detection is especially valuable for industries that rely on secure digital onboarding and must meet strict KYC compliance requirements while preventing identity fraud at scale.

- Financial services

- Fintech

- Crypto and digital asset platforms

- Online marketplaces

- Telecom and remote services

In short, any business that performs KYC verification online can significantly benefit from document liveness detection.

Key Considerations When Implementing Document Liveness

Businesses should assess detection accuracy, spoof resistance, and integration capabilities before implementation. User experience is equally important, as overly complex flows can increase drop-offs.

Data privacy and regulatory alignment are critical. Regulations such as GDPR govern how identity data is handled, while institutions like the National Institute of Standards and Technology provide guidance on secure identity technologies.

The Future of KYC Verification With AI and Liveness Detection

AI verification is rapidly shaping the future of KYC. Static document checks are no longer sufficient against evolving fraud techniques. Document liveness detection will increasingly become a baseline requirement for digital onboarding.

Businesses that adopt modern, AI-driven KYC verification will be better equipped to scale securely, meet compliance expectations, and maintain long-term customer trust.

Choosing the Right Document Liveness Solution

To build a secure and scalable KYC verification process, businesses need more than basic document checks. A reliable ID document liveness solution should deliver real-time fraud detection, strong AI verification, and a smooth user experience. Recognito offers an advanced ID document liveness detection solution that helps organizations prevent document fraud, meet KYC compliance requirements, and onboard customers securely with confidence.

Conclusion

ID document liveness detection is no longer optional for effective KYC verification. It addresses the weaknesses of traditional document checks and protects businesses from modern document fraud.

By strengthening fraud prevention, improving compliance, and building trust, document liveness has become an essential component of secure digital onboarding. Organizations that adopt it today will be better prepared for the future of KYC.

Frequently Asked Questions

What is ID document liveness detection?

It verifies that an identity document is physically present during verification, not a screenshot or reused image.

Why is liveness detection important for KYC verification?

It prevents document fraud and strengthens identity verification in remote onboarding.

How does document liveness prevent fraud?

It blocks replay attacks, injected images, and fake documents through real-time validation.

Is document liveness required for KYC compliance?

While not always explicitly mandated, regulators increasingly expect advanced verification controls.

Can document liveness work with remote customer verification?

Yes, it is specifically designed for online and remote KYC workflows.