Digital payments have evolved quickly over the past decade. Consumers moved from cash to cards, from cards to mobile wallets, and now toward fully contactless experiences. Speed, convenience, and security have become the top priorities at checkout.

As contactless payment becomes the norm, a new payment method is gaining attention: Pay by Face. Instead of using a card, phone, or PIN, customers can complete a transaction using facial recognition. A quick glance at a camera is enough to authenticate and authorize a payment.

In this blog, we explain what Pay by Face technology is, how it works, the technologies behind it, real-world use cases, and what it means for the future of digital payments.

What Is Pay by Face Technology

Pay by Face is a form of biometric payment that allows users to make purchases using their face as the primary method of authentication. It relies on facial recognition to identify the customer and link their identity to a stored payment account.

Unlike traditional digital payments, Pay by Face removes the need for physical cards, mobile phones, or passwords. The user’s facial biometrics act as a secure identifier, enabling fast and hands-free transactions.

This approach is part of a broader shift toward biometric authentication, where physical traits replace something you carry or remember.

How Pay by Face Works

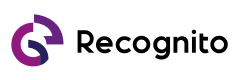

Pay by Face systems follow a simple but secure workflow designed to protect both users and merchants.

Step 1: Facial Enrollment

Before using face payment, users enroll their facial biometrics. This typically happens through a secure application or in-store setup, where the user’s face is captured and linked to a payment method such as a card or digital wallet.

Step 2: Face Recognition at Checkout

At the point of sale, a camera captures a live facial scan. The system uses facial recognition to compare the live image with the enrolled facial template.

Step 3: Biometric Authentication

The system confirms that the face belongs to a real, present person. This biometric authentication step often includes liveness detection to prevent spoofing attempts using photos or videos.

Independent evaluations such as the NIST Face Recognition Vendor Test (FRVT) help measure the accuracy and reliability of facial recognition algorithms used in high-security environments.

Step 4: Payment Authorization

Once the identity is confirmed, the transaction is authorized through the payment network. The entire process usually takes only a few seconds.

Key Technologies Behind Pay by Face

Several technologies work together to enable secure face payment systems.

Facial Recognition

Facial recognition matches a live facial scan against stored biometric templates. Modern systems use advanced algorithms trained on diverse datasets to ensure accuracy.

Biometric Authentication

Biometric authentication ensures that the person initiating the payment is the legitimate account holder, reducing fraud compared to PINs or cards.

Liveness Detection

Liveness detection prevents spoofing attacks by confirming that a real human is present. This is a critical layer for secure biometric payment systems.

Secure Payment Infrastructure

Behind the scenes, encryption and secure processing protect sensitive data. Payment providers follow global security standards similar to those used in traditional card payments.

Why Pay by Face Is Gaining Adoption

Pay by Face is gaining adoption as both consumers and businesses look for faster, more convenient, and fully contactless ways to complete payments.

- Faster checkout without cards, phones, or PINs

- Reduced queues in high-traffic environments

- Improved convenience through hands-free payment

Pay by Face vs Traditional Payment Methods

| Aspect | Traditional Payments | Pay by Face |

| Authentication | Card, PIN, or phone | Facial biometrics |

| Speed | Moderate | Instant |

| User Experience | Multiple steps | Hands-free |

| Security | Risk of loss or theft | Biometric authentication |

| Contactless | Partial | Fully contactless |

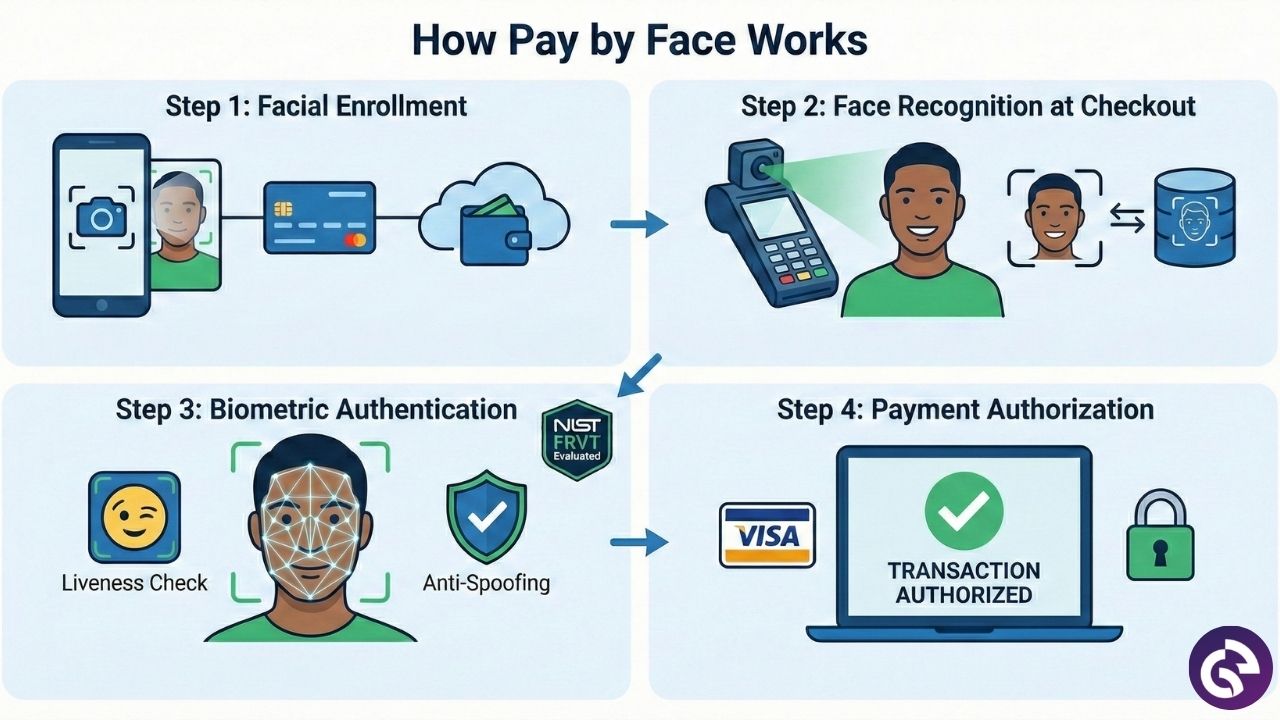

Security and Privacy in Pay by Face Systems

Security and privacy are critical considerations for face payment adoption.

Data Protection and Encryption

Biometric data is typically stored as encrypted templates rather than raw images. This reduces the risk of misuse if systems are compromised.

User Consent and Transparency

Most Pay by Face systems operate on an opt-in basis. Users must explicitly agree to enroll and can choose whether to use facial biometrics for payments.

Regulatory frameworks such as GDPR data protection rules guide how biometric data must be collected, stored, and processed.

Fraud Prevention Measures

Anti-spoofing, liveness detection, and continuous monitoring help reduce fraud risks and maintain trust.

Real-World Use Cases of Pay by Face

Pay by Face technology is already being tested and deployed in several environments:

- Retail stores and supermarkets

- Restaurants and cafes

- Public transportation systems

- Smart vending machines

- Event venues and stadiums

Platforms like Amazon One’s palm and face-based payment experience demonstrate how biometric payments can work smoothly in real-world retail settings.

Benefits of Pay by Face for Businesses and Consumers

Benefits for Consumers

Pay by Face enables faster checkouts without the need to carry cards or phones. The fully contactless process makes payments simple and convenient.

Benefits for Businesses

Businesses benefit from reduced checkout friction and faster transaction flow. Adopting Pay by Face also helps modernize payment experiences and improve customer satisfaction.

The Future of Pay by Face Technology

As facial recognition and biometric authentication continue to improve, Pay by Face is likely to expand into more everyday payment scenarios.

Integration with digital wallets, wider merchant adoption, and improved privacy controls will shape the future of face payment systems. Over time, Pay by Face could become a standard option alongside cards and mobile payments.

How Recognito Supports Pay by Face Technology

Recognito provides the core facial recognition and liveness detection technologies used in Pay by Face systems to enable secure and reliable biometric authentication.

Developers can explore sample implementations and SDK resources through the Recognito GitHub repository, which shows how facial biometrics integrate into real payment workflows.

Contact Recognito to see how our biometric technologies can support your Pay by Face solutions.

Conclusion

Pay by Face technology represents a natural step in the evolution of digital payments. By combining convenience, speed, and biometric security, it offers a compelling alternative to traditional payment methods.

While privacy and adoption challenges remain, continued advances in facial recognition and biometric authentication suggest that Pay by Face will play a growing role in the future of contactless payments.

Frequently Asked Questions

What is Pay by Face payment?

It is a biometric payment method that uses facial recognition to authenticate and authorize transactions.

Is face payment secure?

Yes, when combined with liveness detection, encryption, and secure infrastructure.

Do I need a phone or card for Pay by Face?

No, the payment is completed using facial biometrics alone.

How accurate is facial recognition for payments?

Accuracy is high and continuously evaluated through independent programs like NIST FRVT.

Is Pay by Face privacy-friendly?

Most systems require user consent and follow data protection regulations.